Stellantis cancels Ram Heavy Duty EV plans, triggering $25M supplier lawsuit as the industry grapples with commercial truck electrification challenges amid shifting market realities.

Drivetech Partners

Stellantis' recent cancellation of plans for an electric Ram Heavy Duty pickup truck has sparked a contentious $25 million legal battle between suppliers Valeo North America and American Axle & Manufacturing. This high-stakes dispute, stemming from a project scrapped in April 2024, reveals the financial risks and strategic uncertainties plaguing the electrification of commercial trucks as automakers recalibrate their approaches amid challenging market conditions.

Key Takeaways

Stellantis cancelled its 2027 Ram HD EV plans, triggering a $25 million lawsuit between suppliers who had invested heavily in development

The cancellation reflects broader industry concerns about the business case for heavy-duty electric trucks, especially regarding towing capabilities and profitability

Ram has shifted its electrification timeline, delaying the all-electric 1500 REV to 2026 while prioritizing the hybrid Ramcharger for 2025

Suppliers often bear significant financial risks during automakers' strategic pivots, with Valeo claiming millions spent on e-beam technology development

Stellantis appears to be hedging its powertrain strategy across diesel, hydrogen, and electric options for its commercial truck lineup

The $25 Million Legal Fallout

The April 2024 cancellation of Stellantis' planned electric Ram Heavy Duty pickup truck has triggered a major legal confrontation between two automotive suppliers. Valeo North America filed a $25 million lawsuit against American Axle & Manufacturing (AAM) in January 2025, claiming substantial financial losses after 13 months of collaborative development work. The case, filed in Oakland County Circuit Court, Michigan, could proceed to a jury trial in 2026 if the parties fail to reach a settlement.

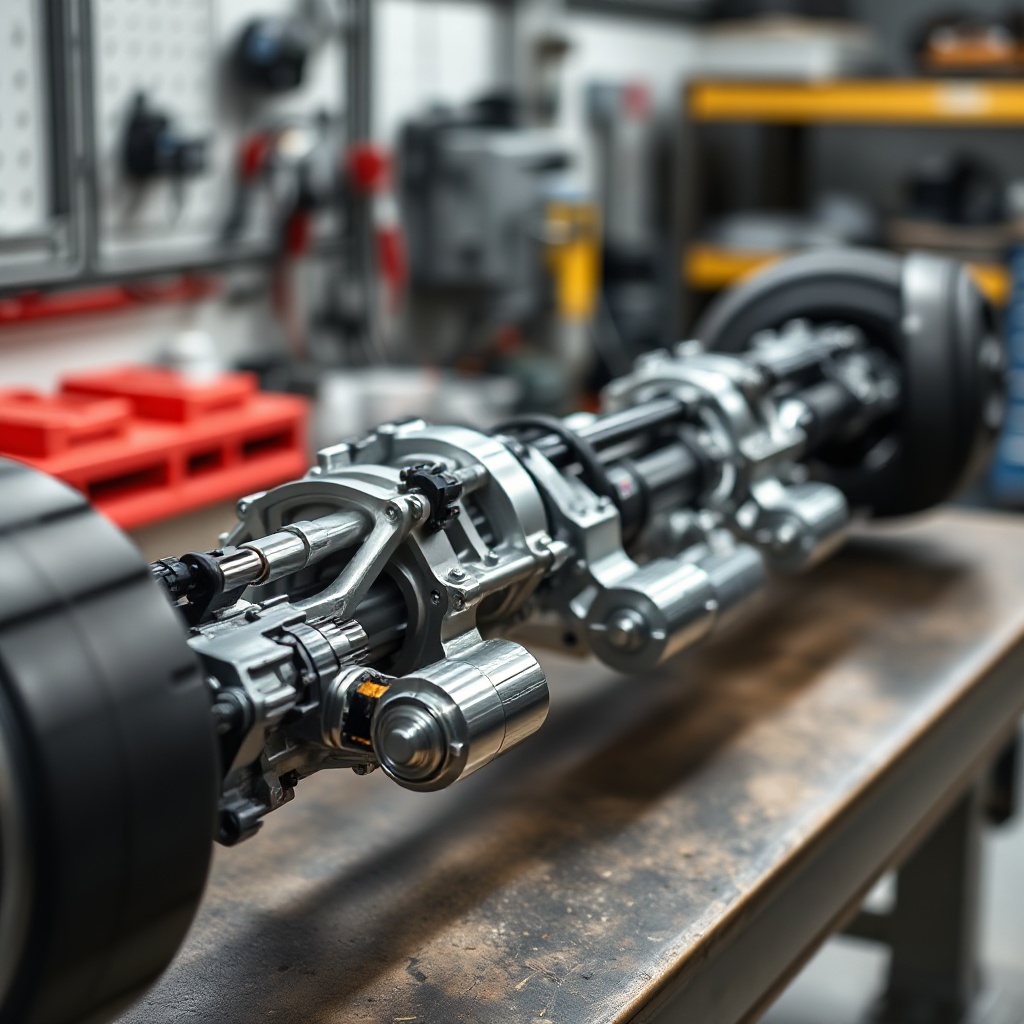

Valeo's lawsuit centers on claims that it invested millions in specialized development of electric motors and inverters for AAM's "e-beams" – axles with integrated electric motors. These components were destined for the now-abandoned Ram HD EV, which would have featured both front and rear e-Beam axles with integrated 3-in-1 e-Drive technology. AAM, meanwhile, contends no enforceable contract existed between the suppliers, despite having announced a contract with Stellantis in 2023 for what was then an unnamed vehicle project.

Ram's Evolving Electric Timeline

The cancelled Heavy Duty EV is just one piece of Ram's increasingly complex electrification puzzle. The brand initially showcased its electric ambitions with the Ram 1500 REV announcement at the 2023 New York Auto Show, promising a revolution in the full-size truck segment. Since then, Ram's electric plans have undergone significant revisions.

The standard Ram 1500 REV, featuring a 168-kWh battery and promising 350 miles of range, has faced multiple delays. Originally slated for a Q4 2024 release, it's now pushed to 2026. More telling was the January 2025 cancellation of the long-range 500-mile Ram 1500 REV version, which would have featured an impressive 229-kWh double-layer battery pack.

Instead, Ram has pivoted to prioritize the 1500 Ramcharger hybrid for an earlier launch in the first half of 2025. This hybrid approach uses a 92-kWh battery paired with a 3.6-liter V-6 range extender, delivering 145 miles of electric range and 690 miles of total range. Both the REV and Ramcharger feature advanced 800-volt charging architecture, with claims of recovering 110 miles in just 10 minutes with 350-kW charging capability.

Market Challenges Forcing Strategic Shifts

The cancellation of the Ram Heavy Duty EV reflects widespread industry concerns about the viability of electric pickup trucks, particularly in the heavy-duty segment. Existing electric pickups, including the Ford F-150 Lightning and GM's Silverado/Sierra EVs, have faced lackluster demand, creating industry-wide apprehension about the market's readiness for electrification.

Ford has publicly acknowledged that large electric vehicles won't turn a profit in the current market, signaling broader financial challenges facing the industry. For heavy-duty trucks specifically, towing capability – a key selling point for these vehicles – remains a significant weak spot for current EV technology, with range drastically reducing under load.

The potential impact of Trump administration policies on EV guidelines has added regulatory uncertainty to an already challenging landscape. In response, Stellantis is actively revising its electrification strategy to address changing consumer trends and market realities. The company is also exploring hydrogen power as an alternative; it currently sells a hydrogen-powered Ram 5500 in Europe that was reportedly planned for US introduction.

The Supply Chain Fallout

The legal battle between Valeo and AAM highlights a critical aspect of automotive development that remains largely invisible to consumers: when automakers cancel vehicle programs, suppliers often bear significant financial burdens without recovery. According to court documents, the Ram HD EV program cost tens of millions of dollars before its cancellation.

Valeo and AAM began negotiations in 2022 for the Ram HD EV components, with Valeo claiming the companies entered an "integrated, comprehensive agreement" for design and manufacturing. Despite this setback, AAM remains the strategic driveline supplier for Ram trucks through 2030.

The dispute exposes how vulnerable supply chain relationships become during major strategic pivots by automakers. Suppliers invest heavily in research and development for specific vehicle programs, often without guaranteed protection if those programs are cancelled. This case may establish precedent for how development costs are handled in the evolving electric vehicle supply chain.

Stellantis' Electrification Retreat

Three years ago, Stellantis confidently pushed all its brands toward an electric future under CEO Carlos Tavares. The company has since walked back several promises and cancelled multiple development projects as market realities have tempered the industry's initial enthusiasm for rapid electrification.

Stellantis only launched its first mainstream electric vehicles for the US market in early 2025 with the Wagoneer S and Charger. These models remain in short supply at dealerships, with some managers reportedly refusing to order the electric vehicles due to demand concerns. Meanwhile, Ram confirmed 25 new models would be released in an 18-month period, suggesting a refocus on conventional powertrains.

Analysts suggest offering both extended-range battery and range-extending gas models would be "redundant" in the product lineup. Instead, the company appears to be hedging its bets across diesel, hydrogen, and electric options for its commercial truck lineup, recognizing that different solutions may be appropriate for different use cases and market segments.

Broader Industry Implications

The Ram HD EV cancellation signals growing caution throughout the auto industry about full electrification timelines, particularly in segments where current battery technology struggles to meet customer needs. The heavy-duty truck segment shows particular resistance to full electrification due to work requirements and customer preferences.

Traditional diesel power remains dominant for commercial applications requiring significant towing capabilities. Hybrid approaches like the Ramcharger may represent a more viable transition technology for work trucks in the near term. The financial case for electric heavy-duty trucks continues to evolve based on fuel costs, electricity prices, and total cost of ownership.

The legal battle between suppliers exposes how quickly automakers can change course, leaving partners with significant losses. Supplier dynamics and financial commitments are rarely visible to consumers but significantly impact vehicle development. Infrastructure limitations remain a significant barrier to heavy-duty electric truck adoption, further complicating the transition path.

The Future of Electric Commercial Trucks

Despite setbacks, electrification remains a long-term goal for commercial vehicle manufacturers due to emission regulations. However, heavy-duty electric trucks face more significant challenges than passenger vehicles due to payload, range, and charging requirements.

Alternative technologies like hydrogen fuel cells may prove more suitable for long-haul and heavy-duty applications. Ram's strategy now appears to focus on intermediate steps rather than full electrification for its most capable trucks, allowing technology to mature before making the complete transition.

Fleet operators continue to watch developments closely as they make long-term purchasing decisions that impact their operational costs. While the immediate outlook for heavy-duty electric trucks has dimmed, the industry continues to invest in solutions that can eventually meet the demanding requirements of commercial applications while addressing environmental concerns.

Sources

CarBuzz - Stellantis Heavy Duty Electric Pickup Cancelled Lawsuit

DriveTech Partners - Secret Ram Heavy Duty EV Truck Cancellation Sparks

StellPower - The Ram REV Appears To Be Dead And Not As Stellantis As Thought

Green Car Reports - Report Ram Cancels 500-Mile 1500 REV Electric Truck

MotorBiscuit - Stellantis 25 Million Lawsuit Electric Ram Truck

Driving.ca - Stellantis Ram HD Heavy Duty EV Electric Pickup Truck Supplier Lawsuit