Stellantis shifts from all-electric to balanced "xEV" approach, investing €50B in electrification while maintaining unified connectivity architecture for 5G and future 6G networks.

Drivetech Partners

Stellantis has significantly shifted its automotive strategy from an all-electric focus to a diversified approach that balances battery electric vehicles with hybrid options, responding pragmatically to market realities and consumer preferences. This strategic pivot not only impacts vehicle production but fundamentally reshapes the company's connectivity roadmap, with implications for its software-defined vehicle (SDV) strategy and future network technologies including 5G Standalone and 6G Non-Terrestrial Networks.

Key Takeaways

Stellantis has adopted an "xEV strategy" balancing BEVs, PHEVs and hybrids, capturing 17.3% of EU30 hybrid market in Q1 2025

The company is investing €50+ billion in electrification and software while maintaining unified SDV architecture across all propulsion types

Advanced 5G Standalone connectivity forms the foundation for current vehicle features with seamless OTA updates regardless of powertrain

6G with Non-Terrestrial Networks represents the next frontier for global, always-on vehicle connectivity beyond urban areas

This balanced approach enables new revenue streams through connectivity-enabled business models while navigating regulatory challenges

The Hybrid Leadership Strategy: Stellantis Redefines Its Electrification Path

Stellantis has made a significant shift from pursuing a singular all-electric vehicle focus to embracing a diversified "xEV" strategy that balances battery electric vehicles (BEV), plug-in hybrids (PHEV), and standard hybrids (HEV). This pivot has quickly yielded results, with the company capturing an impressive 17.3% market share in EU30 hybrid car sales during Q1 2025, establishing itself as the market leader.

The company has gained particular traction in the B-SUV segment with hybrid versions of popular models like the Citroën C3 Aircross, Opel/Vauxhall Frontera, and FIAT Grande Panda. Production of the hybrid Fiat 500 in Turin is already underway with ambitious plans for 130,000 units per year. Despite these advances, Stellantis still relies on external carbon credits (notably from Tesla) to meet EU emissions regulations, as its current EV sales in Europe stand at 14%, below the required 21% target.

Market Headwinds Force Strategic Recalibration

Stellantis' original €30 billion investment plan for electrification and software development through 2025 is now facing significant market challenges. The company has experienced a troubling 9% decline in shipments, with particularly severe impacts in its North American and European markets. This downturn has necessitated production halts at facilities in Canada and Mexico as the company adjusts to changing consumer preferences and US government tariff policies.

Consumer adoption of electric vehicles is progressing substantially slower than industry projections had forecast, especially in North America where traditional powertrains continue to dominate sales. Adding to these challenges, inconsistent green incentive policies and delayed implementation of eco-bonuses have created market uncertainty that further complicates Stellantis' electrification plans.

The company's leadership transition adds another layer of complexity, as it searches for a new CEO following Carlos Tavares' resignation. This change in leadership comes at a critical juncture when the company needs clear direction to navigate these market challenges.

The Dodge Charger Revival: Combustion Engines Return

In a clear signal of Stellantis' shift away from its "all-in" EV strategy, the iconic Dodge Charger is making a comeback with traditional gasoline powertrains alongside electric versions. The revised lineup includes a 420 horsepower four-door model and an even more powerful 550 horsepower two-door SIXPACK variant, both scheduled to launch late 2026.

This strategic pivot reflects Stellantis' recognition of continued market demand for traditional powertrains, particularly in the performance vehicle segment where the emotional connection to combustion engines remains strong. The move represents a significant departure from earlier messaging that positioned Dodge as leading the company's electric transformation.

Balancing Ambition with Market Reality: The Strategic Rationale

This strategic pivot is backed by substantial financial commitment, with over €50 billion allocated to electrification and software development over the next decade. The company has set ambitious targets to develop more than 75 BEV models and achieve 5 million annual BEV sales by 2030, while simultaneously ramping up hybrid production.

“We have a very competitive hybrid solution that we are now ramping up with our new eDCT technology and we are rolling it out across a wide range of models, making it accessible to many customers,” said Sébastien Jacquet, Stellantis Deputy Chief Engineering Officer. “Hybrids are easy to use and don’t require any change in driving habits compared to traditional internal combustion engine vehicles. Our advanced eDCT technology allows the internal combustion engine to remain off, particularly during low-speed driving, resulting in reduced CO2 emissions and fuel consumption. This is not just innovation; it’s innovation within reach of everyone.”

The hybrid pivot effectively provides Stellantis with "breathing space" to catch up with emissions targets while adapting to slower-than-expected consumer adoption of EVs. This approach also addresses the varying global regulatory timeframes and infrastructure readiness challenges across different markets. By maintaining a diverse powertrain portfolio, Stellantis can remain competitive across multiple price points and customer preferences while continuing its electric vehicle scaling efforts.

Software-Defined Vehicle Strategy Across All Powertrains

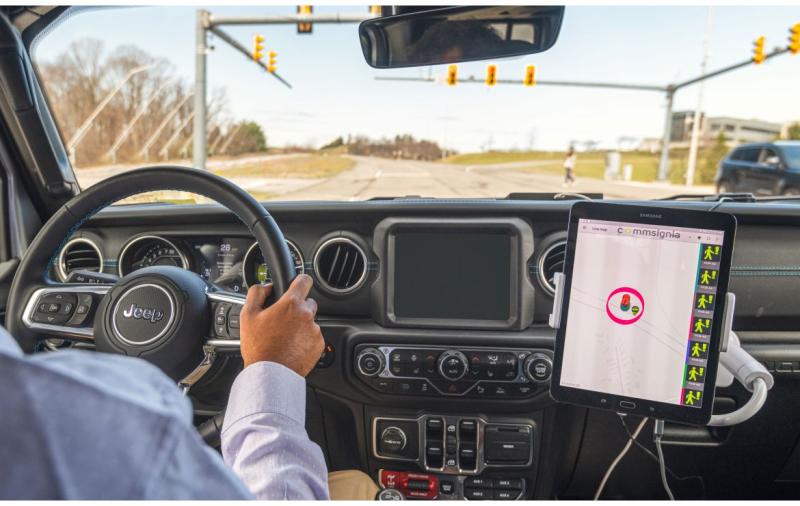

Even as Stellantis diversifies its propulsion options, the company is maintaining consistent SDV architecture investment across its entire portfolio. Vehicle platforms are being developed to accommodate advanced connectivity solutions regardless of the underlying powertrain technology. This approach supports a unified software architecture enabling over-the-air updates, remote diagnostics, and digital features for all vehicle types.

The company is creating a flexible ecosystem for new digital services and pay-per-use features that will work across both electric and hybrid vehicles. This mixed powertrain approach requires an adaptable connectivity stack that can meet the varying needs of different propulsion systems while maintaining a consistent user experience.

5G Standalone: The Foundation for Current Connectivity Solutions

Going forward, Stellantis' connectivity strategy relies on 5G Standalone (SA) deployment to enable high-capacity, low-latency connectivity for today's SDV features. This technology is critical for supporting real-time telematics, autonomous functions, and immersive in-vehicle services across the company's diverse vehicle lineup.

The 5G SA architecture provides the necessary technical foundation for advanced driver assistance systems while supporting seamless OTA updates, map refreshes, and vehicle diagnostics across all propulsion types. The aim is to create a unified connectivity and user experience across Stellantis' diversified vehicle portfolio, ensuring that customers receive the same level of digital services regardless of their vehicle's powertrain.

Beyond Terrestrial: 6G and Non-Terrestrial Networks (NTN) Strategy

Looking ahead, Stellantis is positioning itself for the next generation of connectivity through 6G with integrated NTN (satellite, HAPS), which is emerging as a critical technology for global, always-on connectivity. This approach is especially important for vehicles operating outside dense urban coverage or in remote areas where traditional cellular networks may be unavailable.

The company's 6G-NTN integration aligns with industry standards (3GPP Release 17) and utilizes key satellite frequency bands: n255 (L-band), n256 (S-band), and n1 (HAPS). Technical innovations supporting this strategy include regenerative satellite payloads, unified radio interfaces, and AI-driven network management systems that will keep vehicles connected regardless of location.

The Seamless Global Connection: Technical Requirements

For Stellantis' connectivity vision to succeed, seamless handover between terrestrial and non-terrestrial networks is crucial, particularly for safety-critical services. The company is developing self-organized, softwarized network architectures capable of supporting the data-heavy requirements of modern vehicles across all propulsion types.

European R&D projects, such as 5G-STARDUST, are positioning Stellantis as a technology leader in this space. The company is focused on ensuring compatibility with evolving global connectivity standards across all markets, creating ubiquitous coverage, reducing latency, and supporting consistent OTA capabilities worldwide.

Future Revenue Streams: Connectivity-Enabled Business Models

Stellantis' connectivity strategy enables new mobility-as-a-service and feature-on-demand revenue opportunities that complement its diversified powertrain approach. The hybrid/EV mix supports a broader customer base with varying needs for connected services, allowing the company to tailor its offerings accordingly.

Digital platforms and ubiquitous connectivity are critical for Stellantis' next growth phase, with connected services differentiating its products across all propulsion types. Vehicle data monetization opportunities require advanced connectivity regardless of powertrain, creating a consistent revenue stream potential across the entire product lineup.

Challenges and Competitive Positioning

Despite its strategic pivot, Stellantis faces several significant challenges. Accelerating BEV adoption to meet EU targets while reducing carbon credit reliance remains critically important for the company's long-term regulatory compliance. Integrating hybrid/EV SDV platforms efficiently requires substantial R&D investment that must be balanced against other priorities.

Establishing global 5G/6G connectivity faces infrastructure and regulatory hurdles that vary by region. Maintaining digital competitiveness against BEV-focused rivals requires aggressive innovation in both hardware and software domains. Balancing traditional powertrain support with advanced connectivity investments creates resource allocation challenges that will test management's strategic vision in the coming years.

Sources: stellantis.com - Carbon Net-Zero Strategy, stellantis.com - Electrification, media.stellantis.com - EU30 hybrid car market leadership, cbtnews.com - Stellantis reveals 2025 growth strategy, carboncredits.com - Why Stellantis still needs Tesla's carbon credits