BYD's global strategy: Chinese EV maker aims for 50% international sales by 2030 through vertical integration, global manufacturing, and platform standardization despite trade barriers.

Drivetech Partners

BYD is rapidly transforming from a Chinese electric vehicle (EV) maker to a global automotive force through its ambitious international expansion strategy. With a target to derive half of its sales from overseas markets by 2030, the company is deploying a multi-faceted approach that includes establishing manufacturing facilities across continents and leveraging its vertically integrated business model to challenge established automotive giants worldwide.

Key Takeaways

BYD aims to achieve 50% international sales by 2030, currently at 28.5% of total deliveries with record-breaking overseas shipments in 2025

The company's standardized platform approach enables rapid scaling across markets while maintaining quality and accelerating new model development

The company's vertically integrated supply chain and logistics network gives it significant cost advantages, particularly with in-house battery production that represents up to 40% of an EV's cost

BYD is building a global manufacturing network across Thailand, Brazil, Indonesia, and other emerging markets to support expansion while navigating trade barriers

Despite being effectively locked out of the US market due to high tariffs, BYD has surpassed Tesla for global EV leadership

BYD's Global Ambition: Racing Toward 50% Overseas Sales

BYD has embarked on a remarkable global expansion that has already seen it sell vehicles in over 70 countries. The Chinese EV giant sold 4,272,145 vehicles globally in 2024—a ten-fold increase from 2020—and has set an ambitious target of 5.5 million vehicle sales for 2025, including 800,000 units overseas.

Overseas sales currently represent 28.5% of total deliveries as of early 2025, with April 2025 delivering a record of over 78,000 vehicles overseas, nearly doubling year-over-year. While the domestic Chinese market remains its core strength, BYD's international presence continues to grow rapidly, with top markets outside China including Brazil (76,713 vehicles), Mexico (40,000 vehicles), Thailand (26,981 vehicles), and Australia (20,458 vehicles).

The company's international sales momentum is undeniable—BYD exported over 242,766 passenger new energy vehicles in 2023, representing a 334% increase year-over-year, and sold 417,204 vehicles overseas in 2024. This trajectory puts the company on a path toward its ambitious 50% overseas sales target, though Bloomberg Intelligence analysts suggest this goal might not be achieved until 2030 or later.

Engineering and Platform Innovation: Driving Manufacturing Efficiency

A key element of BYD's global strategy is its platform standardization approach through the Super e-Platform, that was launched in March 2025, which build upon e-Platform 3.0, introduced in 2021. This engineering architecture consolidates core EV and SDV elements into a single framework, creating a foundation that can be adapted across multiple vehicle models and market segments.

BYD's Super e-Platform includes a 1,000V high-voltage architecture, megawatt flash charging, 10C charging battery blades, 30,000 RPM EV motors, next-generation silicon carbide power chips, duel-gun charging connections, and it's in-house BYD OS. BYD claims Super e-Platform is the first mass market EV platform to include full-domain 1,000V charging architecture across the model range. This shared platform significantly reduces parts count, simplifies assembly, streamlines sourcing, and allows quick market adaptations. The company's production lines feature highly automated robotic handling systems that accelerate assembly while maintaining quality standards, enabling rapid scaling across diverse markets.

The benefits of this approach are evident in BYD's product development cycle: models like the BYD Dolphin and Seal were taken from concept to commercial production in under two years thanks to platform sharing. The company has also extensively reengineered vehicles to achieve highest safety ratings in international testing standards, addressing a critical concern for export markets.

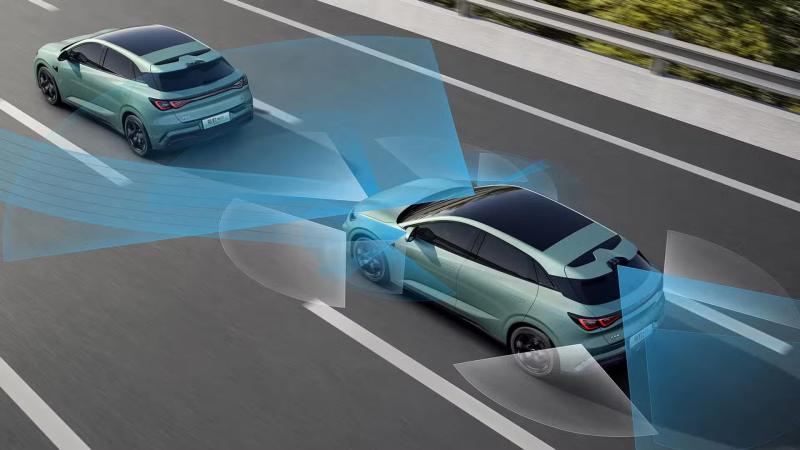

BYD's “God’s Eye” Driving Assistance System

Linked to it's global strategy, BYD officially announced its new “God’s Eye” advanced driver assistance system (ADAS) on February 10, 2025, marking a major step in making intelligent driving technology accessible across its entire lineup. The system, available in three distinct variants, is designed to bring high-end smart driving features-such as highway automation, lane changes, obstacle avoidance, and automatic parking-to a wide range of vehicles, from the affordable BYD Seagull hatchback to luxury models under the Yangwang brand.

Unlike Tesla, BYD will make its "God's Eye" system available to customers as part of the MSRP and not by subsequent software purchases. In comparison, Tesla has lowered their non-LIDAR Full Self-Drive (FSD) solution fee from US$15,000 to US$8,000 upfront or US$99 per month as a subscription. BYD bundles "God's Eye" into the retail price, and no further subscriptions are required. Any "God's Eye" updates are bundled with BYD OS OTAs.

BYD’s chairman Wang Chuanfu emphasized that this move aims to democratize advanced driving technology, predicting that such features will soon become as standard. Chuanfu was quoted by The Straits Times as saying that this year “will be the first of intelligent driving for everybody”. “It will become a must-have in the next two to three years, just as a seat belt or airbag.”

The “God’s Eye” system is being rolled out in three levels to suit different vehicle segments. The entry-level “God’s Eye C” (DiPilot 100) uses a triple-camera setup and will be standard on BYD-branded models, including the Seagull and other vehicles priced from around 69,800 yuan (approximately $9,550). The mid-tier “God’s Eye B” (DiPilot 300), which adds LiDAR sensors, will be featured in premium models under BYD’s Denza and Fang Cheng Bao brands, as well as select flagship BYD vehicles. The most advanced “God’s Eye A” (DiPilot 600) incorporates three LiDAR sensors and is reserved for the high-end Yangwang lineup, including the Yangwang U9, showcasing BYD’s most powerful intelligent driving capabilities. This comprehensive rollout is set to debut on 21 models in 2025, with BYD integrating the technology at no extra cost to consumers.

Vertical Integration: The Secret Weapon for Global Expansion

Unlike other automakers and even Tesla, BYD manufactures nearly all components in-house, including batteries, power electronics, electric motors, software and semiconductors. This comprehensive vertical integration provides significant cost advantages and unparalleled supply chain control during a time when the automotive industry has struggled with parts shortages.

The company's innovative Blade Battery, introduced in 2020, offered enhanced safety, improved energy density, and substantial cost benefits. The updated 10C Blade Battery is expected expand these capabilities and lower battery costs by 15%. Since battery production represents up to 40% of an EV's total cost, BYD's in-house control is a major competitive edge. BYD's LFP battery cells are approximately 32% cheaper than commonly used Nickel Manganese Cobalt (NMC) cells used by many competitors.

By late 2022, BYD's total battery production capacity exceeded 135 GWh. This integrated approach stands in stark contrast to Tesla, which relies on external suppliers like CATL, Panasonic or LG Energy Solution. BYD's strategy gives it greater control over its supply chain resilience and costs—a critical advantage as it takes on global markets.

Manufacturing Expansion: Building a Global Factory Network

BYD is establishing a strategic "hub and spoke" model, using Southeast Asia as an export platform to serve global markets. This approach allows the company to establish regional manufacturing bases that can serve specific markets while avoiding trade barriers and reducing shipping costs.

Current and planned factories outside China include operations in Thailand (operational, 150,000 units annually), Indonesia (150,000-unit plant starting January 2026), Cambodia (20,000-unit annual capacity), and Brazil (production will start June 2025, 150,000 vehicles/year capacity). Additionally, BYD is developing plants in Hungary, Turkey, Uzbekistan, and Mexico—carefully positioning its manufacturing footprint to maximize market access while minimizing exposure to geopolitical risks.

In China, BYD’s new factory in Zhengzhou, Henan Province, is one of the world’s largest manufacturing complexes and is currently under rapid expansion. When fully completed, the facility will span an astonishing 130 square kilometers (about 50 square miles), making it larger than the entire city of San Francisco, which covers approximately 121.5 square kilometers (46.9 square miles). The megafactory is designed to produce over one million electric vehicles annually, with the first phases already operational and additional phases underway to further boost capacity. Beyond its sheer scale, the complex features city-like amenities, including high-rise dormitories, sports fields, shopping centers, and recreational areas for its tens of thousands of employees, reflecting BYD’s ambition to blend industrial might with community infrastructure.

Regional Market Strategies: Tailored Approaches for Global Success

BYD's expansion isn't following a one-size-fits-all model—instead, the company is implementing market-specific strategies based on regional needs and opportunities. The Asia Pacific region (including Thailand, Malaysia, and Australia) represents BYD's second-largest market after China, serving as a critical bridgehead for the company's international growth.

European markets are targeted with higher-end models like the Seal and Tang, addressing the premium segment where profit margins are higher and competition from established manufacturers can be challenged on technology rather than just price. Meanwhile, Latin America serves as a major growth region, with Brazil becoming a manufacturing hub that can serve the broader regional market.

BYD's country-specific strategies involve local production where practical, dealer network development, and model lineup customization based on local preferences and regulations. Importantly, the company focuses on markets where EV adoption is accelerating but competition from established manufacturers is less intense—a strategic approach that maximizes growth opportunities.

Geopolitical Challenges: Navigating Trade Barriers

BYD's global ambitions face significant headwinds in the form of increasing protectionist measures worldwide. Most notably, Chinese manufacturers face exceptionally high tariffs on imports to the United States market, effectively locking BYD out of one of the world's largest automotive markets.

The ongoing trade tensions between China and Western economies create barriers to entry in several major markets. The company must navigate geopolitical uncertainties in potential manufacturing locations like Mexico, where political changes could impact investment security. Despite these challenges, BYD is demonstrating it can achieve global scale through diversification across other markets.

BYD's factory investments in multiple regions help mitigate individual country trade risks, creating a more resilient global presence. While the US market remains largely inaccessible, the company's strategic focus on markets in Southeast Asia, Latin America, and Europe provides alternative growth pathways that could still enable it to achieve its 50% overseas sales ambition.

Competition with Global Automakers: Challenging Industry Giants

BYD is now directly competing against traditional automotive giants like Toyota and Volkswagen while also racing against Tesla for leadership in global electric vehicle sales. The company's vertically integrated model provides significant competitive advantages against traditional automakers still transitioning to EV production.

European manufacturers find themselves in a particularly challenging position, as many depend on Chinese LFP battery supply until they can establish their own supply chains. BYD's comprehensive battery expertise and production capacity puts it ahead of many competitors still struggling with the EV transition.

The company's aggressive pricing and comprehensive model lineup create competitive pressure across multiple vehicle segments, from entry-level cars to premium SUVs. This broad-spectrum approach forces established players to accelerate their EV strategies while competing against BYD's cost advantages and technological integration.

Logistics and Environmental Strategy: Sustainable Transportation Beyond Manufacturing

BYD is extending its environmental focus beyond vehicle manufacturing to encompass its entire supply chain and distribution network. The company is investing in sustainable logistics with dual-fuel LNG (Liquefied Natural Gas) vessels like the BYD 'Explorer No 1', BYD 'Changzhou', BYD 'Hefei', BYD 'Xi'an', BYD 'Changsha' and the BYD 'Shenzhen', which represents a significant scale and innovation in automotive transportation.

The BYD 'Shenzhen' is the world's largest car carrier ship, capable of transporting 9,200 vehicles in a single journey.

BYD has invested CNY5 billion in ships aims to complete its fleet of eight LHG RORO carriers by 2026, taking its annual shipping capacity to over one million vehicles a year.

This integrated global manufacturing and logistics network supports BYD's expansion while allowing it to navigate the increasingly complex web of trade barriers and regional regulations facing Chinese automakers.

To support this expansion, the Xiaomo International Logistics Port in Shenzhen has built two new berths specifically for BYD's RORO (Roll On Roll Off) ships, with capacity for 1 million vehicles by 2030.

By focusing on reducing carbon emissions throughout its operations, BYD is extending the competition beyond manufacturing to encompass the entire supply chain. The strategic placement of factories around the world reduces shipping distances and associated environmental impacts, creating a more sustainable global operation.

These environmental initiatives align with global sustainability trends and regulatory requirements, positioning BYD at the forefront of the transition to zero-emission transportation systems globally. This holistic approach to sustainability enhances the company's brand positioning while creating additional competitive advantages in markets with strong environmental regulations.

Sources: news.metal.com: BYD Targets 50% Overseas Auto Sales by 2030 Led by European and Latin American Expansion, eletric-vehicles.com: BYD targets 50% overseas sales by 2030 report, cnevpost.com: BYD sells 380089 NEVs Apr 2025, electricdrives.tv: BYD pushes for 50% of car sales to come from overseas, english.elpais.com: BYD in Brazil: from the company's triumphant arrival to a scandal involving slavery-

Images: BYD, Xinhua, Shenzhen Ports Association