Comparing autonomous vehicle strategies: Waymo's sensor-rich robotaxis versus Tesla's camera-only approach, with different costs, capabilities, and business models shaping the driverless future.

Drivetech Partners

The automotive industry's autonomous future is dividing into two distinct technological camps, with Waymo's sensor-rich robotaxis currently delivering impressive real-world results while Tesla pursues a more affordable camera-only strategy. This fundamental difference in technological approach has created a high-stakes competition where safety outcomes, regulatory approval, and public acceptance will ultimately determine which company's vision for autonomous mobility prevails.

Key Takeaways

Waymo leads the global autonomous vehicle market with 2.4 million paid robotaxi rides quarterly, using a comprehensive multi-sensor approach combining lidar, radar, and cameras

Tesla's vision-only strategy costs approximately $400 per vehicle versus Waymo's $12,700 sensor suite, creating fundamentally different business models and scaling strategies

Waymo operates in strictly geo-fenced areas with extensive HD mapping, while Tesla aims for "generalized" autonomous driving that can function anywhere

Sensor redundancy provides Waymo with performance advantages in challenging weather conditions where cameras alone may struggle

The ultimate winner may combine elements from both approaches as sensor costs decrease and regulatory requirements evolve

The Current State of Robotaxi Deployment

Waymo has established itself as the clear market leader in autonomous vehicle deployment with 2.4 million paid robotaxi rides per quarter in Q1 2025. This impressive figure significantly outpaces its closest competitor, China's Baidu Apollo Go, which reported 1.1 million rides during the same period.

The company currently operates over 1,500 autonomous vehicles across four major U.S. cities: San Francisco, Los Angeles, Phoenix, and Austin. These vehicles aren't just sitting idle—Waymo's fleet utilization metrics show approximately 250,000 trips completed weekly, with each vehicle averaging between 24-30 trips daily.

What's particularly noteworthy is Waymo's ambitious expansion strategy. The company plans to add 2,000 more robotaxis by 2026 and is scaling manufacturing through their new Mesa, Arizona factory. This facility is designed to eventually produce "tens of thousands" of autonomous vehicles annually, with the flexibility to accommodate additional platforms like the Zeekr RT.

The Technology Divide: Sensor Fusion vs. Vision-Only

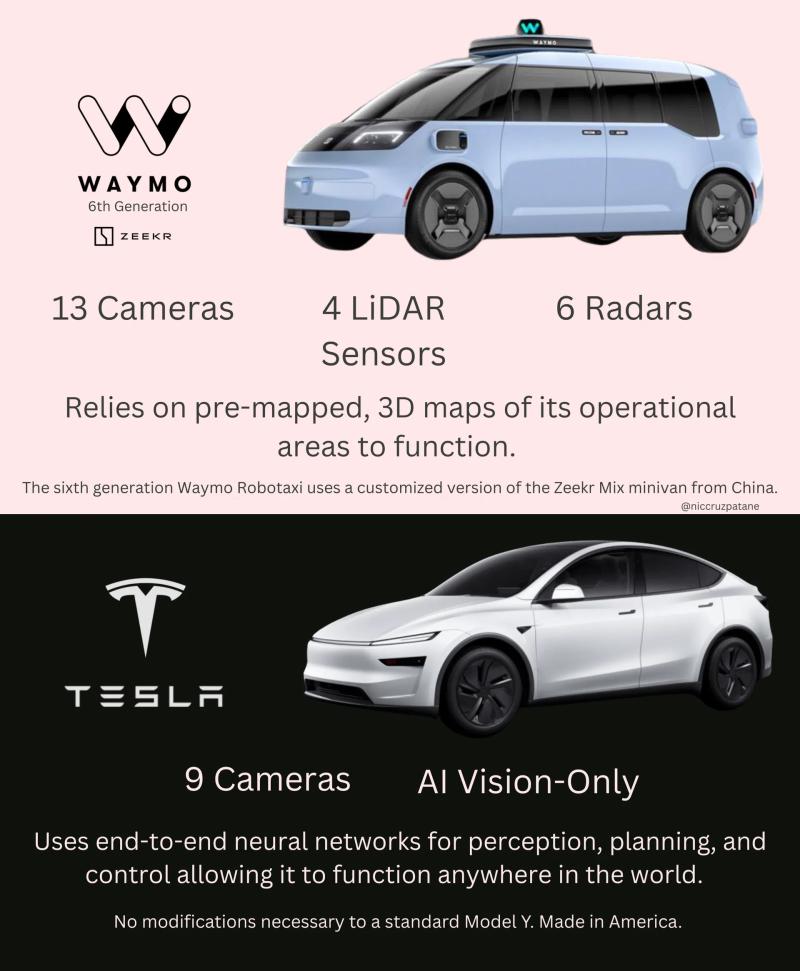

At the heart of the autonomous vehicle race lies a fundamental philosophical difference in technological approach. Waymo's sixth-generation robotaxis employ a comprehensive sensor fusion strategy that combines 13+ cameras, 4 lidar units, 6 radar sensors, and dedicated audio sensors to create detailed environment models.

In stark contrast, Tesla has deliberately chosen a pure vision-based system utilizing 8 cameras and neural networks, while explicitly rejecting lidar and radar. This technological divergence creates an enormous cost differential: Waymo's sensor suite costs approximately $12,700 per vehicle (down significantly from $200,000 in earlier generations) compared to Tesla's mere $400 per vehicle.

Waymo's approach requires extensive HD-mapping of operational areas, creating precise geo-fenced boundaries where their vehicles can operate. Tesla's strategy takes a fundamentally different path, focusing on developing "generalized" autonomous driving through massive real-world data collection—tens of billions of camera miles annually from its global fleet.

Real-World Performance and Safety Considerations

When it comes to real-world performance, Waymo's multi-sensor fusion provides critical redundancy that enables operations in challenging weather conditions including fog, snow, and rain. If one sensor type fails or is compromised, others can compensate—a significant safety advantage.

Tesla's vision-only system faces documented challenges in adverse weather conditions when cameras can be blinded while lidar and radar would still function. Current Tesla FSD disengagement data shows approximately one human intervention required every 13 miles in real-world driving—a metric that highlights the ongoing challenges of a camera-only approach.

Industry experts have weighed in on this debate. Ford's CEO has publicly stated that lidar is "mission-critical" for fail-safe autonomous operation. This perspective aligns with the broader industry consensus that sensor redundancy provides crucial backup systems when primary sensors fail, significantly increasing safety margins.

Operational Design Domains and Scaling Strategies

The contrasting approaches to autonomous vehicle development extend to operational strategies as well. Waymo implements strict geo-fenced operational design domains that limit service areas but enable thorough safety validation. This careful, controlled expansion demonstrates a methodical approach to regulatory approval and safety validation.

Tesla's approach bypasses HD-mapping bottlenecks, theoretically enabling faster geographical expansion and over-the-air software updates. Their mass-market vision relies on software improvements through fleet learning rather than hardware upgrades, potentially allowing for more rapid scaling.

Each strategy comes with trade-offs: geo-fencing provides confidence to regulators but limits market reach, while Tesla's approach targets global scalability but faces heightened safety scrutiny. These fundamental differences reflect each company's vision for how autonomous vehicles should be deployed and monetized.

The Data and Learning Advantage

Tesla's approach leverages its consumer vehicle fleet to collect massive real-world driving data for AI training and software iterations. This data-gathering strategy accelerates learning from diverse environments but may miss critical edge cases that occur rarely but could be catastrophic.

Waymo relies more heavily on simulation and controlled fleet feedback with fewer total miles but deeper situational analysis per event. Their focused data collection in specific operational domains creates high-fidelity understanding of complex urban environments.

The quality versus quantity debate in training data remains central to each company's technological approach. Tesla believes in the power of scale—that with enough data, their neural networks will eventually solve the autonomous driving problem. Waymo counters that targeted, high-quality data from carefully selected scenarios provides more value than raw mileage alone.

Business Models and Market Impact

Waymo's high sensor costs have restricted its business model to centralized robotaxi services rather than consumer vehicles. Their substantial manufacturing investments signal a commitment to scaling beyond test fleets to mass production, but always within the robotaxi service model.

Tesla's low-cost approach is designed for personal ownership with the potential for later robotaxi deployment via existing consumer vehicles. The integration of FSD capability into consumer vehicles creates a potential future robotaxi network without dedicated fleet production—a fundamentally different business model.

These market positioning strategies reflect fundamentally different views on the path to profitability in autonomous transportation. Waymo is betting on higher-margin robotaxi services that can absorb the cost of sophisticated sensors, while Tesla believes in distributing lower-cost hardware widely and potentially activating robotaxi functionality later through software updates.

Regulatory Pathways and Public Trust

Cities and states require multi-stage approval processes for fully driverless deployment, creating regulatory hurdles for both companies. Waymo's expansion success suggests regulatory confidence in sensor-fusion and geo-fencing approaches, which provide clear operational boundaries and redundant safety systems.

Both strategies face intense evaluation of real-world safety metrics, disengagement rates, and data transparency. Investor scrutiny is driving both companies to regularly publish performance data and safety records to build confidence in their approaches.

Public trust remains a critical factor in adoption, with sensor redundancy potentially offering advantages in consumer confidence. The perception of safety—not just actual safety—will play a significant role in determining which approach gains wider acceptance among consumers, regulators, and investors.

The Future Outlook: Convergence or Divergence?

Industry debate continues over whether pure vision systems can eventually match or exceed multi-sensor performance. As sensor costs for lidar and radar continue to decrease, the cost advantage of vision-only systems may narrow, potentially changing the economic calculus for both approaches.

Regulatory requirements may eventually standardize minimum sensor requirements for autonomous operation, forcing convergence on certain safety aspects. Key metrics to watch include disengagement rates, safety incidents per million miles, operational design domain expansion rate, and cost per mile.

The ultimate winner in this technological race may combine elements of both approaches or develop entirely new sensing technologies. The robotaxi revolution is still in its early stages, and the path to fully autonomous vehicles continues to evolve as real-world performance data accumulates and technologies mature.

Sources

EE Times EU - Waymo's Robotaxi Program: Progress and Potential

Contrary Research - Deep Dive: Tesla, Waymo, and the Great Sensor Debate

The Driverless Digest - Waymo Plans to Add 2000 More Robotaxis

Viks Newsletter - Tesla's Big Bet: Cameras Over Lidar

Waymo - Scaling Our Fleet Through U.S. Manufacturing

Teslarati - Ford CEO Favors Waymo Lidar vs Tesla Vision