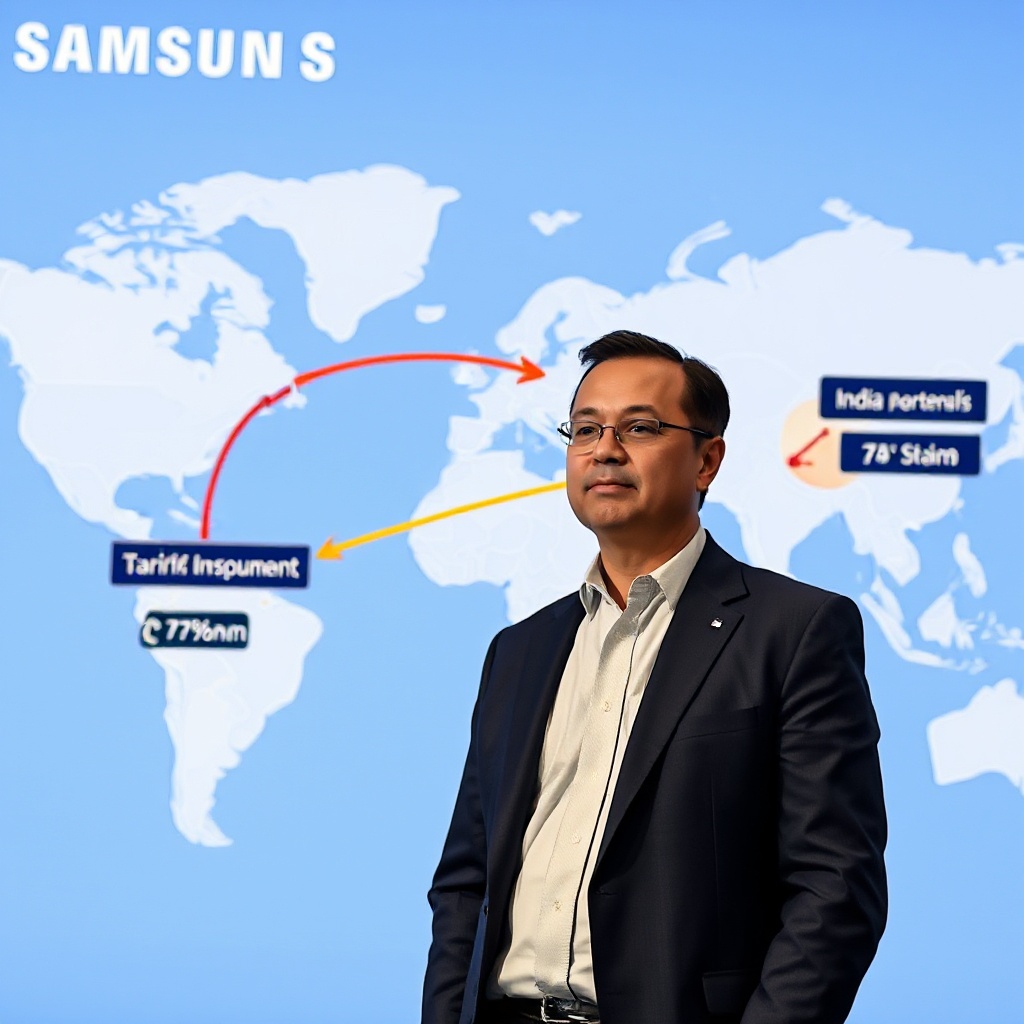

Samsung posts record Q1 2025 results amid pre-tariff buying surge, plans to shift production from Vietnam to India to mitigate US tariff impact.

Drivetech Partners

Samsung has reported record-breaking Q1 2025 results with revenue of ₩79.14 trillion ($54 billion) and operating profit of ₩6.7 trillion ($4.7 billion), driven largely by customers accelerating purchases before US tariff implementation. Despite these impressive figures, the tech giant is actively preparing contingency plans to relocate manufacturing from high-tariff regions like Vietnam to countries with more favorable rates such as India while executives across all divisions warn of market uncertainties ahead.

Key Takeaways

Samsung posted all-time high Q1 revenue of ₩79.14 trillion ($54 billion), but executives warn this may reflect pre-tariff buying behavior rather than sustained demand

The company is considering shifting production from Vietnam to India to mitigate the impact of a 46% US tariff on Vietnamese imports versus 26% on Indian imports

Despite strong Q1 results, executives across all business divisions have expressed concern about elevated uncertainties throughout 2025

Samsung is increasing R&D investment by 16% year-over-year while developing premium products including new AI-infused tablets and health-focused smartwatches

The current 90-day tariff pause period (excluding China) provides a limited window for strategic manufacturing adjustments

Record-Breaking Q1 2025 Performance

Samsung's first quarter of 2025 has yielded exceptional financial results, exceeding the company's own forecasts with revenue reaching ₩79.14 trillion ($54 billion) and operating profit hitting ₩6.7 trillion ($4.7 billion). This represents a 1.2% increase year-over-year, an impressive achievement given the challenging global economic climate.

The successful launch of the Galaxy S25 flagship lineup contributed significantly to these results, with the mobile division showing particularly strong performance. However, Samsung executives have tempered enthusiasm about these numbers by acknowledging they may partially reflect accelerated customer purchases ahead of impending US tariff implementation rather than sustainable growth.

The company has also demonstrated its commitment to future innovation by increasing R&D expenditure by 16% compared to the previous year, investing 9 trillion won in Q1 alone to maintain its technological edge in an increasingly competitive market.

Tariff Landscape Reshaping Global Strategy

Samsung now faces a complex tariff structure that threatens its current manufacturing model. The most significant challenges include:

A 46% tariff on Vietnamese imports to the US

A 26% tariff on Indian imports

A 10% baseline global tariff that remains in effect

This situation is particularly concerning given that Vietnam has been Samsung's main mobile production hub, exporting over $52 billion in products during 2024. The current 90-day tariff pause period (which notably excludes China) provides only a limited window for strategic adjustments as Samsung reconfigures its global manufacturing footprint.

Executives from Samsung's semiconductor, display, smartphone, and foundry divisions have all issued warnings about potential demand slowdown in the latter half of 2025 as the full impact of US-China trade tensions and evolving tariff policies takes effect.

Manufacturing Relocation Plans

In direct response to the tariff situation, Samsung is actively considering relocating manufacturing operations from Vietnam to India, which would allow the company to benefit from a 20% tariff differential (46% vs. 26%) on products destined for the US market.

The company has entered negotiations with several Indian contract manufacturers including Dixon Technologies and Bhagwati Products (Micromax) to facilitate this transition. This strategic pivot mirrors similar moves by other tech giants like Google, indicating an industry-wide shift in response to the changing trade landscape.

If these plans materialize, India could emerge as a major hub for global electronics manufacturing, fundamentally altering the geography of technology production. The transition won't be without challenges, as establishing new supply chains and manufacturing capabilities involves significant investment and operational disruption in the short term.

Mixed Divisional Performance

Samsung's semiconductor division posted ₩25.1 trillion in revenue and ₩1.1 trillion in profit, supported by strong AI server demand but facing headwinds from datacenter project delays and weak SSD sales. Foundry services continue to feel pressure from US-China tensions despite technological advances in nanometer processes.

The display and smartphone divisions present a mixed picture. While current performance remains strong, both have flagged potential weakness later in 2025 as pre-tariff buying behavior subsides and economic uncertainties take hold. Smartphone demand specifically is projected to decline in Q2 2025 due to a combination of seasonal factors and tariff-related uncertainty.

To counter these challenges, Samsung has increased its R&D expenditure significantly, with a 16% year-over-year rise representing 9 trillion won invested in Q1 alone. This substantial commitment to innovation underscores the company's determination to maintain its competitive edge despite market volatility.

Premium Product Focus

As a strategic response to market uncertainty, Samsung is placing increased emphasis on high-margin premium products across its portfolio. This includes the Galaxy S25 lineup, advanced video displays, and premium home appliances that can command better profit margins even in challenging market conditions.

The company's product roadmap features several promising developments:

New smartwatches with enhanced health-related features

An AI-infused Galaxy Tab planned for release later in 2025

Advanced robotics initiatives leveraging both internal R&D and external partnerships

Exploration of innovative form factors including tri-fold smartphones

This focus on premium, feature-rich products aims to secure market advantage while justifying higher price points that can help offset increased operational costs associated with manufacturing relocation and supply chain adjustments.

Pre-Tariff Buying Surge Masks Challenges

Samsung's exceptional Q1 performance has been partially inflated by a pre-tariff buying surge, with customers rushing to purchase products before tariff implementation. This pattern has been observed across technology and consumer electronics sectors, creating a temporary demand spike that may not be sustainable.

Company executives have explicitly warned that this temporary surge could lead to reduced demand in the latter half of 2025 as the market normalizes following the initial rush. To counter this anticipated slowdown, Samsung is increasing its marketing efforts for premium products while carefully analyzing long-term supply chain reconfiguration options beyond immediate manufacturing shifts.

The company's leadership is taking a measured approach to these challenges, balancing short-term tactical adjustments with strategic long-term planning to ensure sustainable growth despite trade-related disruptions.

Competitive Landscape Transformation

The entire technology industry is experiencing widespread supply chain disruption as manufacturers reassess production locations in response to evolving tariff structures. India stands to benefit significantly from this shift as companies seek lower-tariff manufacturing alternatives.

During this transition period, operational costs are expected to rise across the industry. To compensate, companies including Samsung are investing in automation and AI to enhance productivity at new manufacturing sites, potentially offsetting some of the costs associated with relocation.

The ongoing trade tensions are creating unpredictable competitive dynamics across semiconductor, display, and consumer electronics markets. Those companies able to adapt most efficiently to the new reality may find themselves with significant competitive advantages as the landscape continues to evolve.

Technology Roadmap Prioritizes AI

Despite market uncertainty, Samsung maintains unwavering commitment to innovation, particularly in next-generation semiconductor technologies. AI capabilities are being embedded across product lines from smartphones to home appliances as the company seeks to differentiate its offerings in increasingly competitive markets.

A continued focus on semiconductor manufacturing innovations aims to maintain Samsung's technological edge, while strategic partnerships with AI software providers enhance product functionality and user experience. The company's leadership clearly believes that technological differentiation will be key to justifying premium pricing and maintaining market share despite economic headwinds.

This approach aligns with Samsung's increased R&D investment, demonstrating the company's determination to emerge from the current period of trade-related disruption in a stronger competitive position through innovation and adaptation.

Sources:

The Register - Samsung execs fear impact of US tariffs

Light Reading - Smartphones power Samsung profit as it preps for tariffs

Mobile World Live - Samsung mobile unit soars, warns of tariff impact

Business Standard - Samsung mulls shifting production from Vietnam to India amid US tariffs

SamMobile - Samsung confirms it may relocate some production sites to avoid US tariff impact