800V EV technology transforms the industry with faster charging, better performance, and 30% market growth, led by Asia-Pacific's infrastructure investment and innovation.

Drivetech Partners

The electric vehicle industry stands at a pivotal turning point as 2025 marks the significant acceleration of 800V powertrain technology across global markets. China and the broader Asia-Pacific region are driving this revolution with aggressive infrastructure investments and supportive policies, showcasing how higher voltage systems represent a fundamental shift that dramatically enhances charging speeds and vehicle performance through advanced silicon carbide technology.

Key Takeaways

The 800V EV market is projected to grow at a 30% CAGR over the next five years, substantially outpacing traditional automotive sectors

Asia-Pacific, especially China, leads global adoption through aggressive infrastructure investment and comprehensive EV policies

800V systems deliver twice the charging speed of conventional 400V architectures, dramatically reducing charging downtime

Premium brands like Porsche and Hyundai currently dominate implementation, but mass-market adoption is accelerating

The global EV powertrain market will reach USD 159.8 billion by 2035, growing at 23.1% annually as high-voltage systems become mainstream

Technical Advantages Driving the 800V Revolution

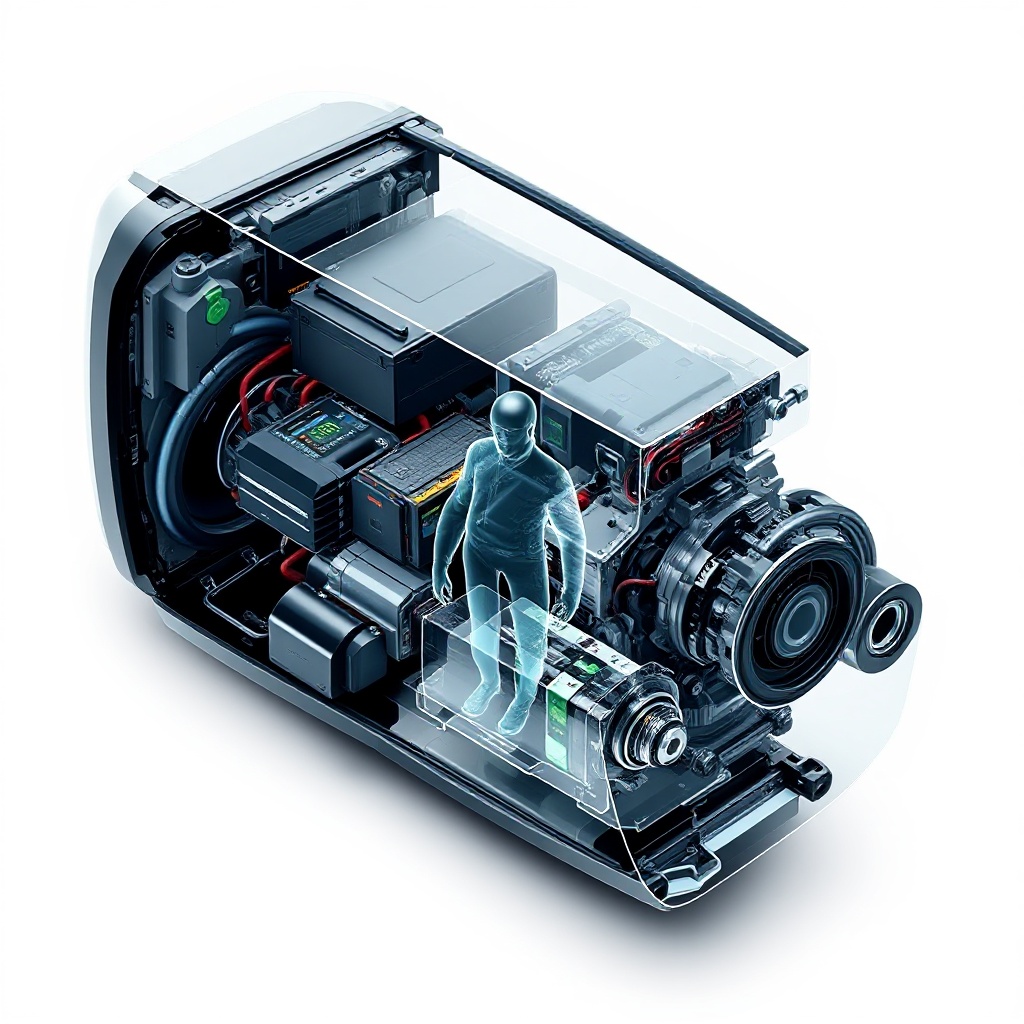

The shift to 800V architecture represents more than just an incremental improvement in EV technology—it's a fundamental redefinition of electric vehicle capabilities. Compared to conventional 400V systems, 800V powertrains deliver significantly higher efficiency through improved energy management and reduced power losses throughout the vehicle.

Perhaps the most compelling advantage for consumers is the dramatically faster charging capability. 800V EVs can charge up to twice as quickly as their 400V counterparts, transforming the refueling experience from a potential inconvenience to something approaching the speed of traditional gasoline refills. This enhancement directly addresses one of the primary barriers to EV adoption.

Beyond charging speed, the technology delivers several other critical advantages:

Extended vehicle range through reduced power losses

Enhanced performance with more responsive power delivery

Improved regenerative braking efficiency

Silicon carbide (SiC) semiconductor technology in inverters that substantially reduces heat loss

Better overall thermal management throughout the powertrain system

The combination of these benefits creates a compelling value proposition for both manufacturers and consumers, explaining why the industry is racing to implement this technology across vehicle segments.

Market Growth Projections and Economic Impact

The financial implications of the 800V revolution are substantial. The global EV powertrain market, valued at approximately USD 20 billion in 2025, is projected to reach USD 159.8 billion by 2035, reflecting a compound annual growth rate of 23.1%. Within this broader category, the 800V segment specifically is growing even faster, with a projected CAGR of 30% over the next five years.

This accelerated growth coincides with overall EV market expansion. Electric car sales are expected to exceed 20 million vehicles worldwide in 2025, representing more than one-quarter of global car sales. The integration of higher-voltage architecture is positioned to gain market share rapidly during this expansion phase.

Contributing to this market value is the integration of advanced materials and components specifically designed for high-voltage systems. Lightweight materials that can withstand higher operating temperatures are becoming increasingly important in the design and manufacturing of these systems, adding both performance benefits and economic value to the finished products.

Asia-Pacific's Strategic Dominance

When analyzing regional adoption patterns, the Asia-Pacific region—with China at the forefront—is clearly leading the global transition to 800V systems. This leadership position stems from several strategic advantages:

China has implemented some of the world's most aggressive EV policies, including comprehensive subsidies for vehicle purchases, significant investments in ultra-fast charging infrastructure, and supportive regulatory frameworks that incentivize both production and adoption of high-voltage EVs. These policies create a favorable environment for rapid technological advancement and market penetration.

Beyond China, other regional powers are making substantial contributions. Japan and South Korea are driving innovation through companies like Hyundai, Toyota, and Panasonic. Japan's early embrace of hybrid technology—representing 61% of total hybrid vehicle sales and 31% of in-country new car sales in early 2016—has created a strong foundation for next-generation EV adoption.

The region's integrated supply chain for advanced electronics and battery components provides additional advantages in scaling production of high-voltage systems. This established ecosystem allows for faster innovation cycles and more efficient manufacturing processes compared to regions still developing these capabilities.

Premium Manufacturers Leading Implementation

The initial wave of 800V adoption has been concentrated among premium automotive brands, with companies like Porsche, Hyundai, Kia, Lucid Air, CHANGAN AUTO, and Xpeng leading implementation. These manufacturers have targeted luxury and performance segments where the additional cost of high-voltage systems can be more easily absorbed into higher vehicle price points.

Tesla stands out as a pioneer in bringing proprietary high-voltage architecture to more mainstream vehicle segments, leveraging its vertical integration and direct sales model to manage costs while delivering advanced technology to a broader market.

The current market structure remains highly concentrated, with a relatively small number of manufacturers accounting for a significant market share. However, this concentration is beginning to shift as mid-range electric vehicle segments follow the lead of premium brands in adopting 800V systems.

Commercial applications are also gaining traction, particularly in light commercial vehicles (LCVs). The faster charging capabilities of 800V systems offer compelling operational advantages for fleet operators who prioritize vehicle uptime and quick turnaround between deliveries or service calls.

Critical Component Evolution

The transition to 800V systems has sparked rapid evolution across several key component categories:

Battery Systems: 800V battery packs are being designed to enable higher energy efficiency and significantly faster charging capabilities. These systems require more sophisticated cell management and thermal control to safely handle the increased power flow.

Inverters and Converters: Silicon carbide (SiC) based power electronics are revolutionizing the efficiency of high-voltage management. These components convert DC power from batteries to AC power for motors with less energy loss and heat generation compared to traditional silicon-based semiconductors.

Electric Motors: 800V-compatible motors deliver enhanced torque and improve energy recovery during regenerative braking. These higher-voltage motors can be designed with improved power density, reducing overall vehicle weight.

Onboard Chargers: Advanced designs ensure compatibility with the growing network of ultra-fast charging stations. These components must handle the higher power levels safely while maintaining compatibility with existing charging infrastructure.

Beyond individual components, system-level integration is becoming increasingly important for maximizing efficiency gains. Manufacturers are focusing on how these components work together as a unified system rather than as isolated parts.

Infrastructure Development and Market Drivers

The expansion of ultra-fast DC charging infrastructure is a critical enabler for widespread 800V powertrain adoption. These charging stations, capable of delivering power at 350kW or higher, make the full charging-speed advantages of high-voltage systems accessible to everyday consumers.

Regulatory support for EV adoption is pushing manufacturers toward 800V technology across global markets. The European Union's requirement for zero-emission vehicles by 2035 is creating particular urgency for technological advancements that can make EVs more appealing to mainstream consumers.

Battery technology advancements are simultaneously reducing costs and improving the performance of high-voltage systems. Innovations in cell chemistry, thermal management, and manufacturing processes are making 800V batteries more practical for mass-market implementation.

Consumer demand for reduced charging times is creating market pull alongside the regulatory push. As more drivers experience the convenience of ultra-fast charging, expectations are shifting, creating competitive pressure for manufacturers to adopt high-voltage systems.

Challenges to Overcome for Mass Adoption

Despite the compelling advantages, several significant challenges remain before 800V systems can achieve truly widespread adoption:

Cost remains a substantial barrier, particularly for non-premium vehicle segments where profit margins are already thin

Raw material dependencies create supply chain vulnerabilities that could affect production scaling

Pricing inconsistency and geopolitical constraints may limit growth in certain regions

Standardization of ultra-fast charging protocols is needed to ensure interoperability across vehicle brands

Developing cost reduction strategies without compromising performance is essential for mass-market EVs to achieve price parity with internal combustion engines

The industry is actively addressing these challenges through collaborative research initiatives, vertical integration strategies, and increased investment in manufacturing capacity. The pace of innovation suggests that many of these obstacles will be substantially reduced by mid-decade.

Sources

marketresearch.com/BIS-Research-v4011/800V-Electrified-Powertrain-Systems-Electric-39876323

datainsightsmarket.com/reports/800v-electric-vehicle-134108

iea.org/reports/global-ev-outlook-2025/executive-summary

futuremarketinsights.com/reports/ev-powertrain-market

exaputra.com/2025/05/global-race-for-electric-vehicle

bisresearch.com/industry-report/800v-electrified-powertrain-systems-market-for-electric-vehicles