Hino champions hybrid trucks as a practical stepping stone to zero emissions in Australia while competitors focus on battery-electric and hydrogen fuel cell technologies for commercial transport.

Drivetech Partners

While Australia's trucking industry largely races toward battery-electric and hydrogen fuel cell technologies, Hino remains steadfast in championing hybrid trucks as a practical solution for the transition to zero emissions. This growing divide has ignited debate about whether hybrid trucks deserve consideration as a strategic stepping stone in Australia's commercial transport decarbonization journey, especially given their proven operational benefits and lower infrastructure demands.

Key Takeaways

Most Australian truck manufacturers have bypassed hybrid technology in favor of battery electric (BEV) and hydrogen fuel cell (FCEV) solutions, with Hino being the notable exception

Hybrid trucks offer immediate emissions reductions without requiring specialized infrastructure, making them practical for fleets seeking gradual decarbonization

BEVs are gaining significant market momentum in urban settings where their range limitations and infrastructure needs are less problematic

Hydrogen trucks represent a future opportunity but face substantial infrastructure and cost challenges before reaching widespread adoption

A multi-technology approach to transport decarbonization may be necessary, with hybrids serving as a transitional technology in specific applications

The Current Landscape: Australia's Leap Toward Zero Emissions

Australia's commercial truck sector is undergoing a significant transformation as manufacturers and fleet operators face mounting pressure to reduce emissions. While most global truck manufacturers have opted to leapfrog hybrids entirely, moving directly toward battery electric and hydrogen fuel cell vehicles, Hino stands apart by maintaining their commitment to hybrid technology in the Australian market.

The drive to completely decarbonize heavy transport has pushed manufacturers toward end-goal solutions rather than incremental improvements. This strategy aligns with government incentives that increasingly target zero-emission vehicles rather than partial solutions like hybrids. The result is a market with clear technological lanes but ongoing questions about practical adoption timelines.

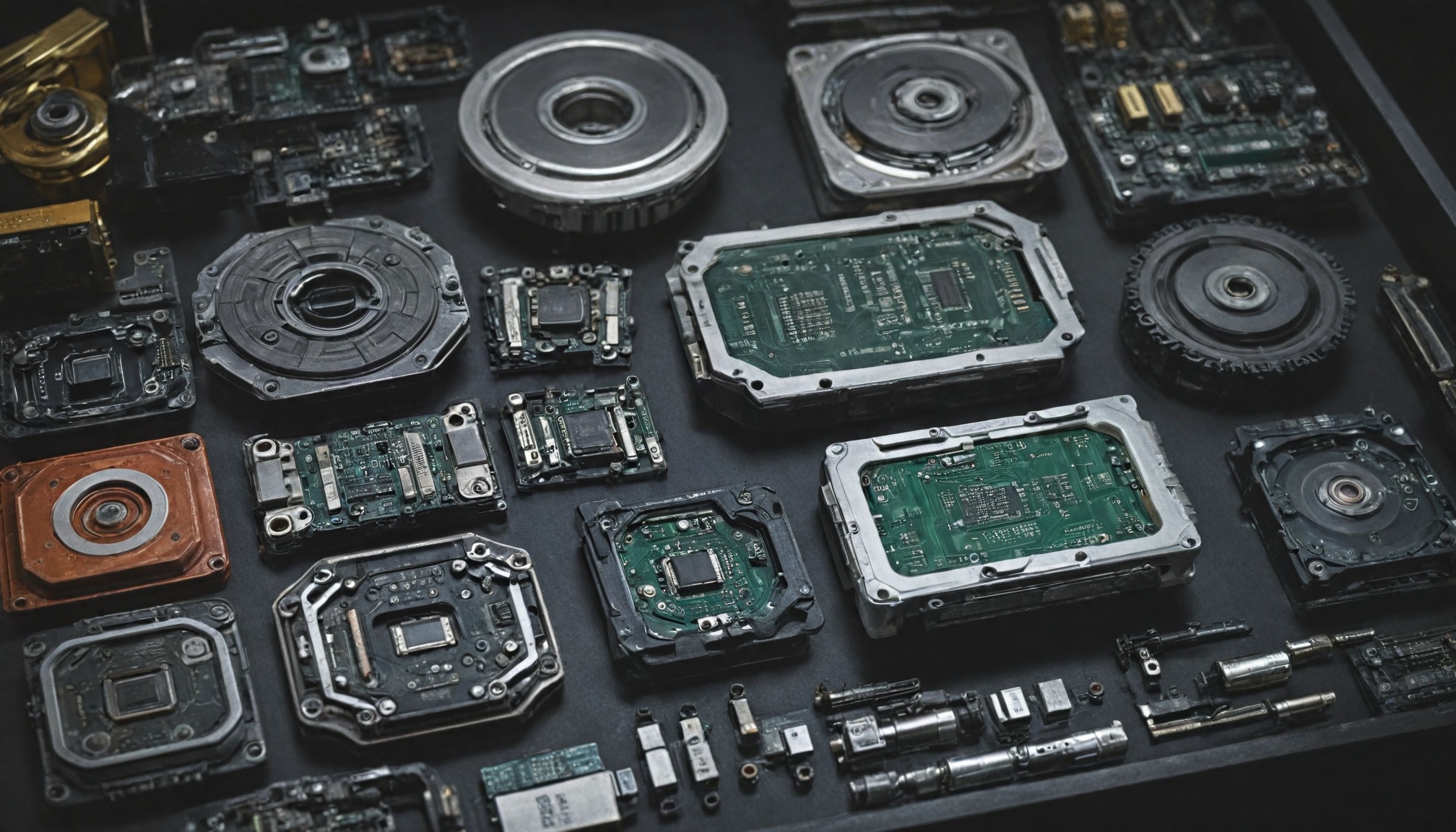

Hybrid Performance: Real-World Australian Experience

Despite being sidelined in broader industry conversations, hybrid trucks have demonstrated tangible operational benefits in Australian conditions. The City of Charles Sturt has reported significant fuel savings and CO₂ emissions reductions with their Hino hybrid truck fleet. These vehicles have also shown lower maintenance costs compared to conventional diesel trucks, offering financial advantages alongside environmental benefits.

A key advantage of hybrid trucks is their operational flexibility. Unlike full BEVs, hybrids don't face range anxiety or charging infrastructure limitations, making them particularly valuable for local councils and urban logistics operators seeking immediate emissions reductions without operational compromises. They continue to use standard diesel infrastructure while delivering meaningful environmental improvements.

For fleets without access to charging infrastructure or those seeking a lower-risk transition path, hybrids offer a practical middle ground. They provide:

Reduced fuel consumption and associated CO₂ emissions

Lower maintenance requirements compared to conventional diesel trucks

No need for specialized charging infrastructure

Familiar operational practices for drivers and fleet managers

Battery Electric Trucks: Urban Advantages, Infrastructure Challenges

BEV sales in Australia continue to surge, with 14 electric truck models now available locally. Battery electric rigid trucks have reached cost-competitiveness with diesel in urban applications, creating substantial opportunity given that rigid trucks represent approximately two-thirds of urban freight movements.

The urban logistics sector presents an ideal early-adoption scenario for BEVs. These vehicles excel in predictable routes with regular return-to-base operations, where limited range is less problematic and charging infrastructure can be concentrated. They also offer additional benefits beyond emissions reduction, including lower operational noise, improved driver comfort, and significant air quality advantages in urban environments.

Registration data confirms this growing momentum. As of May 2025, 11,191 BEVs were registered in the ACT compared to 15,174 hybrids and just 9 hydrogen vehicles. However, BEV adoption faces continued challenges outside urban centers, where:

Range limitations become more problematic for regional and interstate transport

Charging infrastructure availability remains inconsistent

Higher upfront costs can deter operators without access to incentives

Charging times impact operational efficiency for time-sensitive deliveries

Hydrogen Trucks: Future Promise vs. Present Reality

The Australian hydrogen truck market presents a compelling long-term growth story, with revenue forecast to grow at 23.1% CAGR from 2025-2030, potentially reaching USD 190.7 million by 2030. However, hydrogen-powered heavy vehicles aren't expected to reach commercial maturity until the 2040s, creating a significant gap between industry aspirations and market readiness.

Current challenges for hydrogen adoption include severe infrastructure limitations, exceptionally high vehicle costs, and recent market withdrawals—notably Hyzon Motors leaving Australia. These obstacles highlight the practical difficulties in transitioning to hydrogen despite its theoretical advantages for long-haul and heavy transport applications.

Industry stakeholders are working to address these limitations. The Australian Hydrogen Transport Forum, led by major players Hyundai, Toyota, and BMW, aims to accelerate infrastructure development. However, the practical timeline for widespread hydrogen truck adoption remains distant compared to more immediately viable alternatives.

Fleet Operator Considerations: Balancing Aspirations with Reality

Australian fleet operators face difficult decisions when planning their decarbonization strategies. While many have set ambitious goals—expecting 11.9% to 36.9% of medium to large fleets to be zero- or low-emission vehicles by 2025—the practical implementation challenges often create gaps between aspiration and reality.

For many fleets, particularly those operating outside urban centers, hybrid trucks offer a pragmatic balance. They deliver immediate emissions benefits without requiring specialized infrastructure investment, providing a lower-risk pathway toward decarbonization compared to full BEVs or hydrogen vehicles.

Total cost of ownership calculations are increasingly favorable for electric options in specific contexts, primarily urban operations with predictable routes. However, these calculations vary significantly based on:

Operational patterns and daily distances

Access to charging or refueling infrastructure

Availability of government incentives

Vehicle replacement cycles and depreciation timelines

Energy costs and projected fuel price increases

Strategic Transition Pathways for Australian Transport

Modeling from Deloitte suggests a staggered approach to transport decarbonization is most practical for Australia. This involves deploying urban BEVs in the short term for immediate gains, using renewable diesel as an interim solution by 2036, and introducing hydrogen trucks for long-range and heavy applications from the 2040s onward.

Electric vehicles are expected to dominate Australian road transport over a multi-decade timeframe. However, hybrid technology may serve a meaningful role as a bridging solution where BEV or hydrogen infrastructure is unavailable or impractical, particularly in regional areas or specialized applications.

This transition timeline will be shaped by several factors:

The implementation of efficiency standards and emissions targets

Cost trajectories for different technologies

Infrastructure development speed and coverage

Policy consistency and incentive availability

Policy Recommendations and Future Outlook

For Australia to effectively decarbonize its commercial transport sector, coordinated policy support will be essential. Government backing for charging and hydrogen refueling infrastructure development remains critical to zero-emission vehicle adoption, as infrastructure limitations present one of the most significant barriers to wider uptake.

Policy incentives should consider total cost of ownership rather than focusing solely on upfront purchase costs. This approach would recognize the value of hybrid trucks as a lower-risk decarbonization option in the interim while zero-emission vehicle infrastructure develops across the country.

Looking ahead, multiple technology pathways will likely be necessary for complete decarbonization of different freight segments. Urban delivery may rapidly transition to full electric, while regional and interstate freight may follow a more gradual path through hybrid technology before ultimately adopting hydrogen or advanced battery solutions as they mature.

The challenge for policymakers remains balancing ambitious environmental targets against practical operational needs, ensuring Australia's commercial transport sector can reduce emissions without compromising the essential services it provides to the economy.

Sources

GoAuto - Truck industry dismisses hybrids – except Hino

Electric Vehicle Council - Electric trucks: Keeping shelves stocked in a net zero world

Fleet EV News - When will hydrogen and renewable diesel be ready?

Grand View Research - Australia Hydrogen Truck Market

Fleet EV News - Hybrid electric truck also reduces emissions

Electrek - Hydrogen trucks retreat from Australia as battery electric sales surge